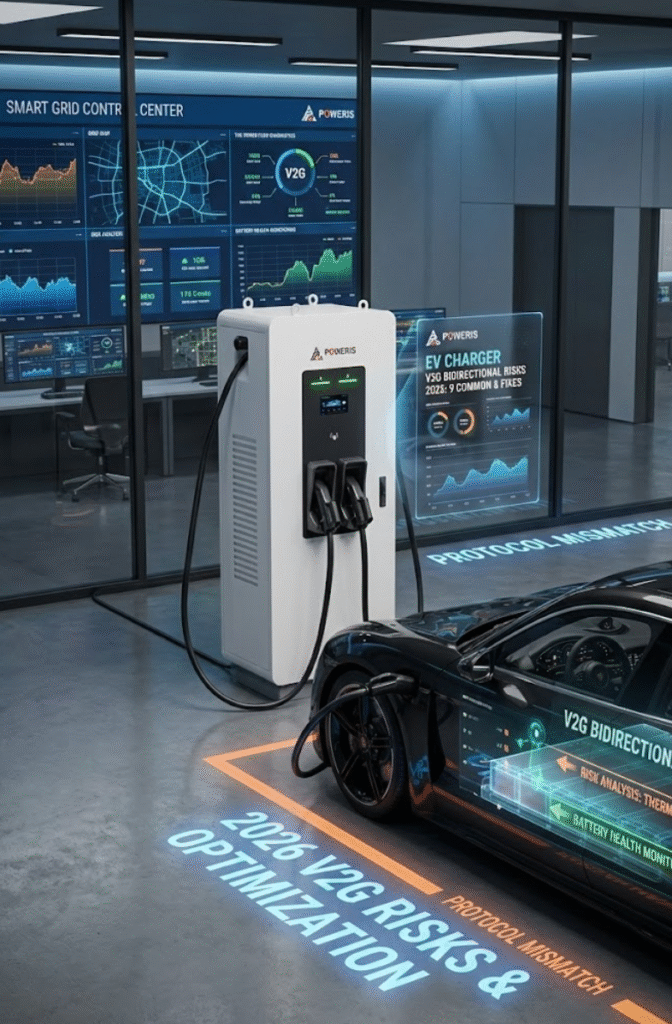

EV Charger V2G Bidirectional Risks 2026: 9 Common & Fixes | POWERIS

V2G (Vehicle-to-Grid) lets your EV charger turn cars into mobile batteries—selling power back to the grid for revenue. But many 2026 pilots face unexpected failures, battery wear, or revenue shortfalls. From real EU CPO and fleet operator reports, 75% of V2G project issues stem from bidirectional risks, not hardware limits. This guide maps 9 common risks and proven fixes to maximize returns while protecting assets.

What Are V2G Bidirectional Risks?

Bidirectional risks arise when charging hardware, vehicle battery, or grid protocol fails to safely handle power flow in both directions. Common client complaint: “V2G promised €500/month revenue, but battery degradation cost us €2,000 in warranty claims”—often from unoptimized charge/discharge cycles.

How to Identify V2G Risks Early?

Watch for these signals:

- Battery health drop >10% faster than normal.

- Frequent handshake failures during discharge.

- Heat spikes during bidirectional sessions.

Table: 9 Common V2G Bidirectional Risks in 2026

| # | Risk Type | Typical Impact | 2026 Trigger Factor | Early Detection Method |

|---|---|---|---|---|

| 1 | Battery degradation from cycles | 15-30% faster capacity loss | High-frequency V2G discharge | Battery SoH monitoring |

| 2 | Protocol/handshake mismatch | 20-40% failed sessions | V2G OCPP 2.0.1 incompatibility | Log handshake errors |

| 3 | Thermal stress in bidirectional | Overheating shutdowns | Ultra-fast + V2G simultaneous | Temp >70°C during discharge |

| 4 | Grid instability during discharge | Voltage fluctuations | Weak grid + high-power feed | Voltage log during V2G |

| 5 | Revenue shortfalls | 30-50% less than projected | Tariff changes or low grid demand | Compare actual vs expected revenue |

| 6 | Warranty voids | Denied claims | Non-certified V2G cycles | Check OEM V2G approval |

| 7 | Communication latency | Delayed response | 5G/edge computing gaps | Latency logs >500ms |

| 8 | Energy round-trip inefficiency | 15-25% loss | Conversion losses in bidirectional | Measure grid-to-vehicle vs return |

| 9 | Regulatory compliance gaps | Fines or shutdowns | AFIR V2G rules 2026 | Audit against AFIR standards |

Leverage 2026 trends for risk reduction:

- Certified V2G hardware:Choose OCPP 2.0.1 + OEM-approved batteries.

- AI cycle optimization:Limit deep discharge cycles, predict grid demand.

- Thermal & grid monitoring:Active cooling + real-time voltage tracking.

- Revenue stacking:Combine V2G with peak shaving and frequency response.

Remark:1. EV Charger V2G bidirectional risks = hidden stresses from power flow reversal, amplified by 2026 ultra-fast and grid integration trends.

2. Risk Warning Type: Pushing V2G without cycle limits isn’t revenue—it’s accelerating battery replacement by 2-3 years.

3. Boundary Type : 75% of V2G project failures in 2026 stem from bidirectional risks, preventable with right hardware and software.

FAQ

- Q: What’s realistic V2G revenue per station in 2026?

- A: €300–800/month with AI optimization; below €200 signals risks.

- Q: How to protect battery health in V2G?

- A: Limit discharge to 20-80% SoC, use predictive AI scheduling.

Share your V2G pilot experience or biggest risk with POWERIS to get discuss further.