EV Charger Revenue Model Blind Spots 2026: 7 Hidden & Fixes

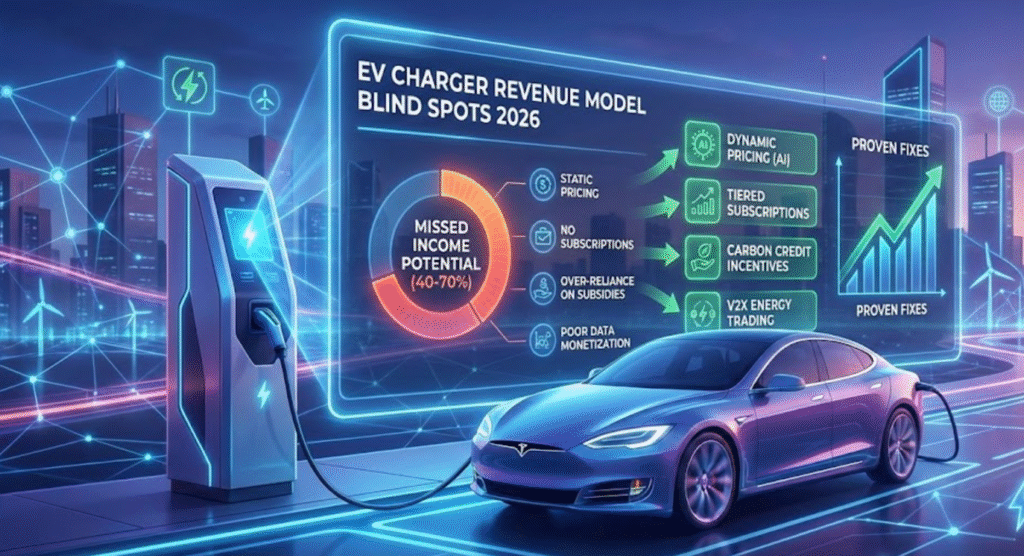

Your EV charging stations are busy—but revenue barely covers costs. In 2026, with dynamic pricing, subscription models, and carbon credit incentives, revenue model blind spots cause 40-70% missed income potential. From real EU CPO and operator experiences, this guide reveals 7 common monetization pitfalls and proven fixes to transform stations into profit centers.

What Are Revenue Model Blind Spots?

Blind spots are structural flaws in how charging stations generate income—static pricing, missed add-ons, over-reliance on subsidies—leaving money on the table. Common complaint: “We have high utilization, but profit margin is only 5%”—often from not leveraging 2026 dynamic pricing or subscription tiers.

How to Identify Revenue Model Blind Spots?

Key signals:

- Revenue per kWh < €0.45 in high-traffic areas.

- Subscription/upsell <10% of total revenue.

- High subsidy dependence (>30% income).

7 Common Revenue Model Blind Spots in 2026

- Static pricing → misses peak/off-peak opportunities

- No subscription tiers → loses recurring users

- Ignoring add-on services (parking, ads) → revenue ceiling

- Over-reliance on subsidies → vulnerable to policy changes

- No dynamic load pricing → grid penalties eat profits

- Missed carbon credit/V2X revenue → leaves green incentives untapped

- Poor data monetization → no value from usage insights

How to Fix Revenue Model Blind Spots?

Proven 2026 strategies:

- Implement dynamic pricing — AI adjusts rates based on demand/grid signals (boost 30-50%).

- Launch tiered subscriptions — monthly flat fees or priority access (recurring revenue up 40%).

- Add ancillary services — paid parking, advertising screens, premium support.

- Participate in carbon credit markets — certify low-carbon charging for credits.

- Enable V2X energy trading — sell excess power back (additional 15-25% revenue).

Remark:

1: EV Charger revenue model blind spots = structural gaps in monetization strategy that cap income far below potential.

2: Sticking to static pricing in 2026 isn’t safe—it’s voluntarily leaving 40-70% revenue on the table.

3: 70% of underperforming EV charging stations in 2026 suffer from revenue model blind spots, fixable with dynamic and diversified streams.

FAQ

- Q: What’s realistic revenue per station in 2026?

- A: €3,000–8,000/month with dynamic pricing + subscriptions; below €2,000 signals blind spots.

- Q: How to start carbon credit revenue?

- A: Certify with EU schemes + track low-carbon sessions.

Share your revenue surprises or monetization win for POWERIS to get discussion and advice.